Housed below is a summary report of work I did for a Data Analytics II course at SNHU. Fictional

company, Austin Air, is looking to enter the international airline industry with a goal of capturing

a significant market share of business focused around Nigeria. Available data was examined and a data

analysis life-cycle plan was created. Three datasets were of particular interest, and these could be

connected via unique identifiers. As over 90% of the data within the datasets were categorical, a frequency

analysis approach was used to discover trends within the industry.

Process

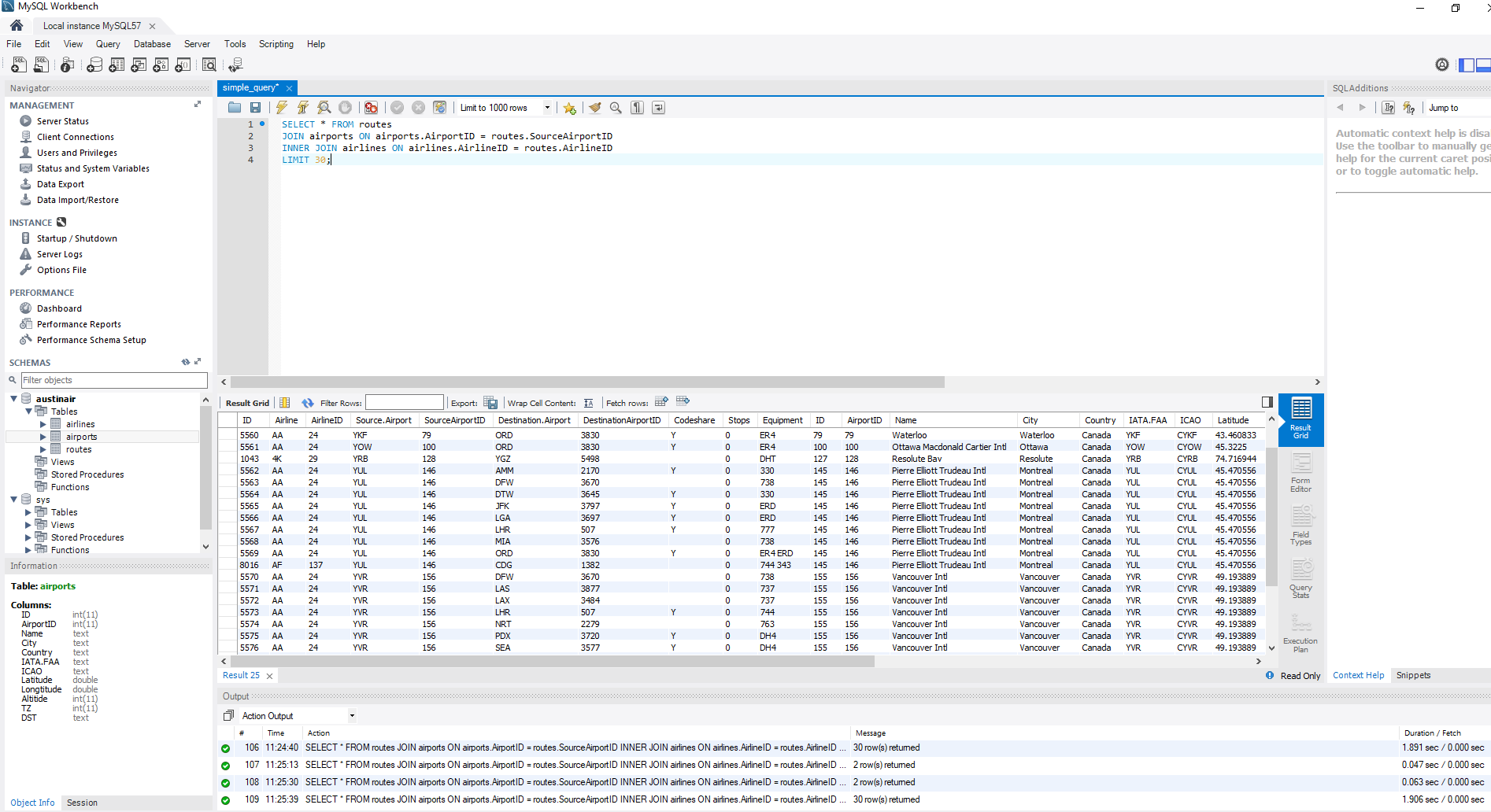

I initially imported the data into R and used this program to clean and explore the data. Once cleaned,

the data were written out and stored into a relational format via a MySQL database. I then utilized ggplot2

in R to create the presentation visuals, while using Tableau to create three dashboards- each one with a particular

flight segmentation focus. Additionally, JMP was used occasional to perform some quick statistical tests when needed.

Once visuals were created, results were detailed on in the summary report to indicate suggested business strategies for

the company. Although a lack of time-series knowledge largely hampered the possibilities of analysis, three particular

findings are focused on which could be leveraged by Austin Air. I believe the insights determined through this analysis

can start Austin Air on the correct path towards achieving their goals.

All data and working files can be found on my github

Austin Air Analysis - Summary Report (Partial)

Austin Air is seeking to capture a significant portion of the Nigerian airline industry away from the currently dominate European companies. The following summary report provides a look at the current status of the Nigerian airline industry and leverages historic data to suggests an appropriate strategy for Austin Air to enter the market. Frequency analysis has specified three specific business strategies in particular for Austin Air to implement towards achieving their goals. Firstly, Austin Air should initially invest into only three specific plane types: 73G, A333, and DH8. A suggested distribution of these plane type for the company’s initial fleet is also included below. Secondly, the report suggests locations, domestic and international, which should be included in the beginning, pilot program for Austin Air. Lastly, analysis designates two airliners, Arik Air and Ethiopian Airlines, as direct competitors and proposes further avenues of research towards leveraging this knowledge positively for Austin Air. Utilizing the data-driven insights highlighted throughout this report, Austin Air can efficiently and effectively achieve their goal of capturing a signification portion of the Nigeria air travel industry.

Data Processing

Collection Methods and Integration Tactics

The data utilized throughout this project was a collection of airport, airline, and air-route information sourced in January 2012. This data was obtained by Austin Air and provided to the team for processing and analysis. Although no collection time-frame was indicated, one assumption can be made based upon size of the air-routes dataset: The data accounts for no more than a few days’ worth of flight route information. This can be implied from the number of flights to and from each airport in the dataset.

Integration of the data revolved around connecting the airline and airport data to the routes dataset, which contained both an airline ID and an airport ID. Joining via these identifiers resulted in a unified version of the data with all necessary information connected and accessible. R dataframe merging techniques were utilized to complete this step for exploratory data analysis, while SQL foreign keys were used to connect the data within a relational database as well.

Data Enrichment Processes

Missing Values

Data enrichment began with cleaning the data. This first step, even before integration, was to check for missing values to either impute values for or remove. ~1,194 rows were missing the necessary connector variables of either airline ID or airport ID. It was determined that there was no acceptable method to figure correct values and, instead of possible introducing errors into the analysis, these rows were removed. As these rows account for only 2% of the data and no rows directly relate to Nigerian airports, it was an acceptable choice to omit. Outside of ID values, few other rows required editing. Although there were numerous IATA/ICAO codes missing, these were unnecessary for the goals of this analysis, and therefore ignored.

Subsetting

After cleaning, the data were integrated together and subset. As Austin Air’s goals all focus upon the Nigerian air-travel industry, data was subset to encompass only routes which included a Nigerian airport as its source and/or destination. This allowed analysis to convey the trends seen specifically within the Nigeria market- including routes from Berlin to New York, for example, would be not only useless, but detrimental to analysis of the Nigerian market. This Nigerian subset was then subset three more times during EDA to provide a more granular look at domestic v. international (from Nigeria) v. international (to Nigeria) flights.

Feature Generation

Finally, new features were generated to facilitate frequency analysis techniques. The primary variables of interest are plane types, destination/source airports, and airlines. Each of these variables had a ‘count’ variable created and added to the dataset to promote easy exploratory analysis in R. Although nonstop v connecting variables were expected to have provided information relevant to scheduling flight routes for Austin Air, a quick look indicated that there were only 24 connecting flights in the dataset (<.01%). As such, this course of analysis was scraped for lack of data.

Data Positioning

Once cleaning, feature generation, and preliminary analysis were conducted, data were then stored into a relational database. R was used to split and rewrite the data into three organized and cleaned csv files: airports_cleaned, airlines_cleaned, and routes_cleaned. Although MS SQL Server was initially planned for storage, unforeseen circumstances (virtual environment downtime) required the use of MySQL (w/ Workbench) instead.

As seen above, a query was used after data insertion to confirm proper storage and alignment of the data. All relevant data to this analysis are held within the ‘AustinAir’ database, and each route can be connected to appropriate airline and airports via calling on foreign key identifiers.

Results

As expected by the analysis team, both time-series and regression analysis were not practical considering the data available. Time-series modelling was out due to the lack of any type of time variables, while even a naïve model is impossible due to the lack of knowledge regarding the time-frame of collection. Rather than predict needed fleet size by estimating flight volume for a time-period as planned, the approach was changed and focused instead on figuring plane type distribution of the fleet based upon competitor airlines. Similarly, regression techniques are most applicable when predicting some base numeric dependent, which was also lacking in the available data. Since over 90% of the variables recorded are categorical, frequency analysis was determined as the best route to achieving useful results from analysis.

Visualization Strategies

Relating results from frequency analysis hinges on creating informative and easily understood tables and histograms. Utilizing two different visualization methods, Austin Air stakeholders and management can be presented with visuals which convey: the appropriate fleet size to invest in, the top competitors in the market, and locations which should be included in the initial phases of the pilot program. The two visualization methods utilized to relate analysis results are a presentation and a dashboard.

Presentation

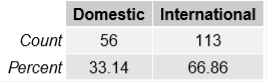

Although Austin Air is looking to venture into the international market, the domestic consumer can not be forgotten. About 1 in 3 travelers in the Nigerian airline market are domestic flyers.

Although most of the presentation focuses on international trends and patterns, major domestic routes between Nigerian airports should be considered by Austin Air as well so as not neglect 1 out of every 3 fliers.

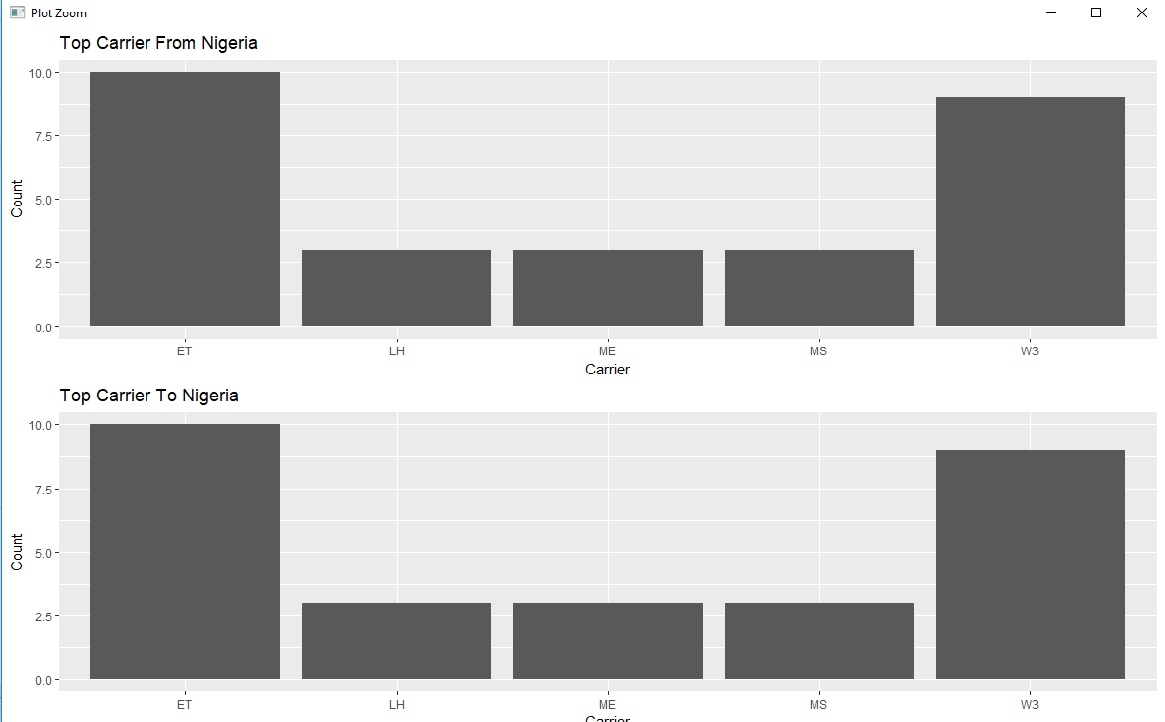

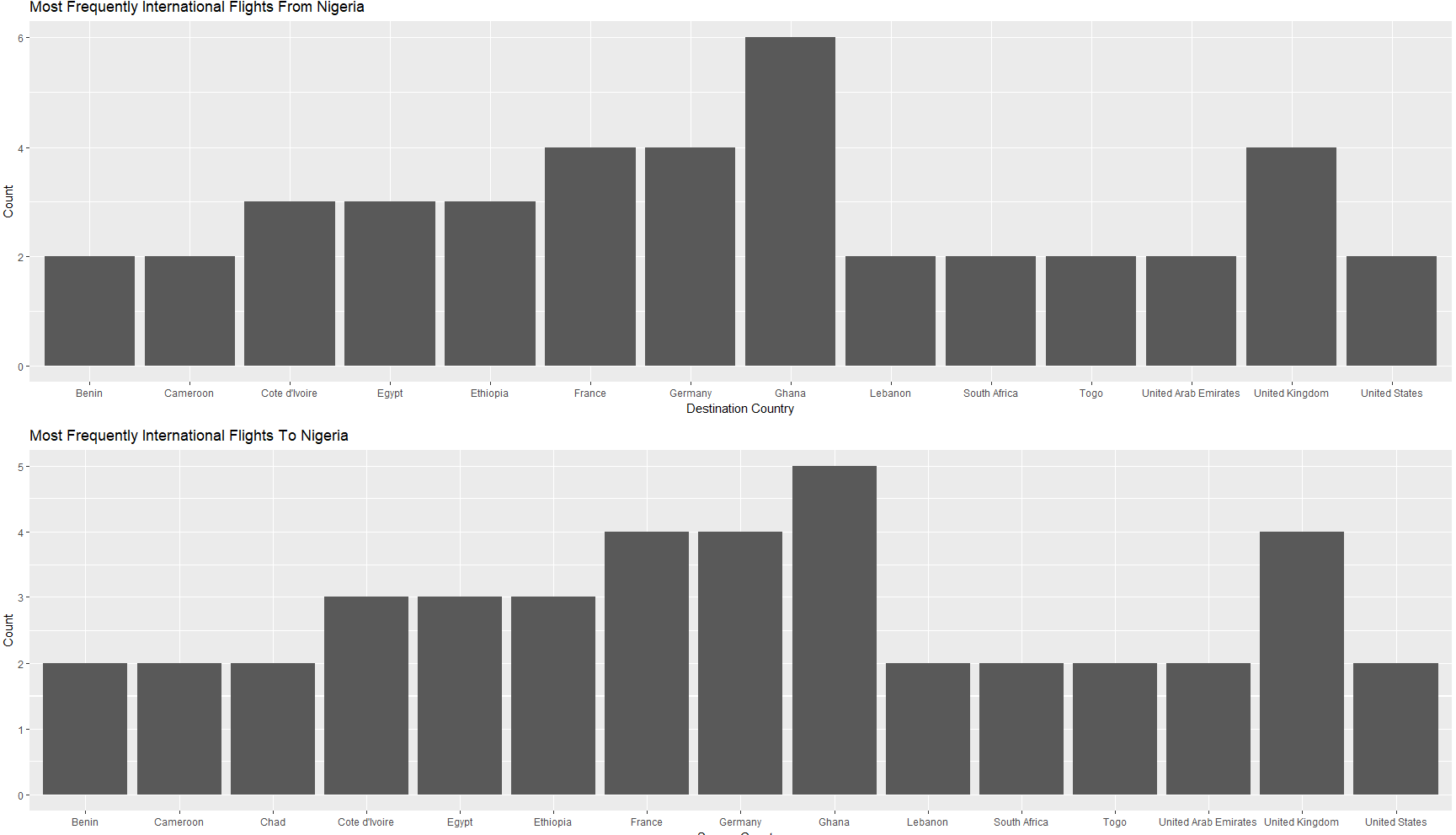

Charts relating international distributions are split into two different histograms: One representing flights into Nigeria and one representing flights from Nigeria. The first chart is a look at the top international competitors to Austin Air.

Ethiopian Airlines and Arik Air are the airlines consumers typically chose for international travel to and from Nigeria. Therefore, these two companies should be considered Austin Air’s primary competition.

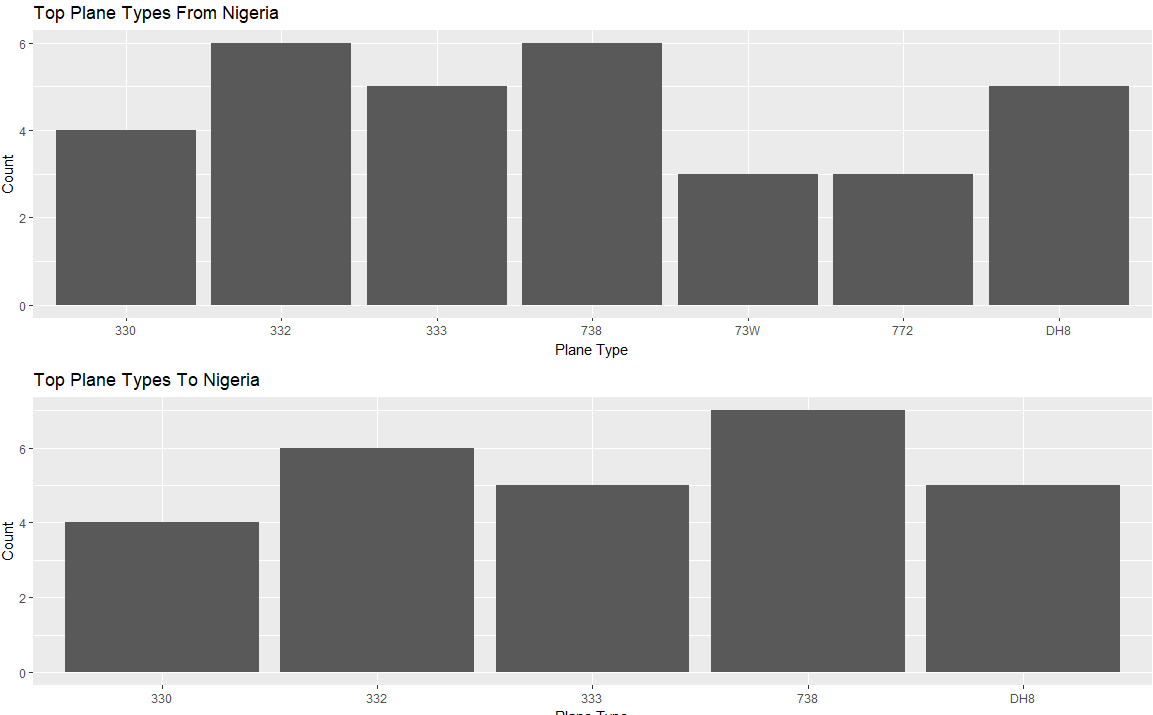

The next look is the distribution of the top plane types flying to and from Nigeria.

As seen above, international flights are typically on: 738’s; 330, 332, and 333 Airbuses; and Bombardier Dash 8s. Although domestic is considered additionally in the dashboard below, this chart indicated that investment into these plane types would be valuable for international routing.

Next for the presentation is a histogram of countries of interest for Austin Air.

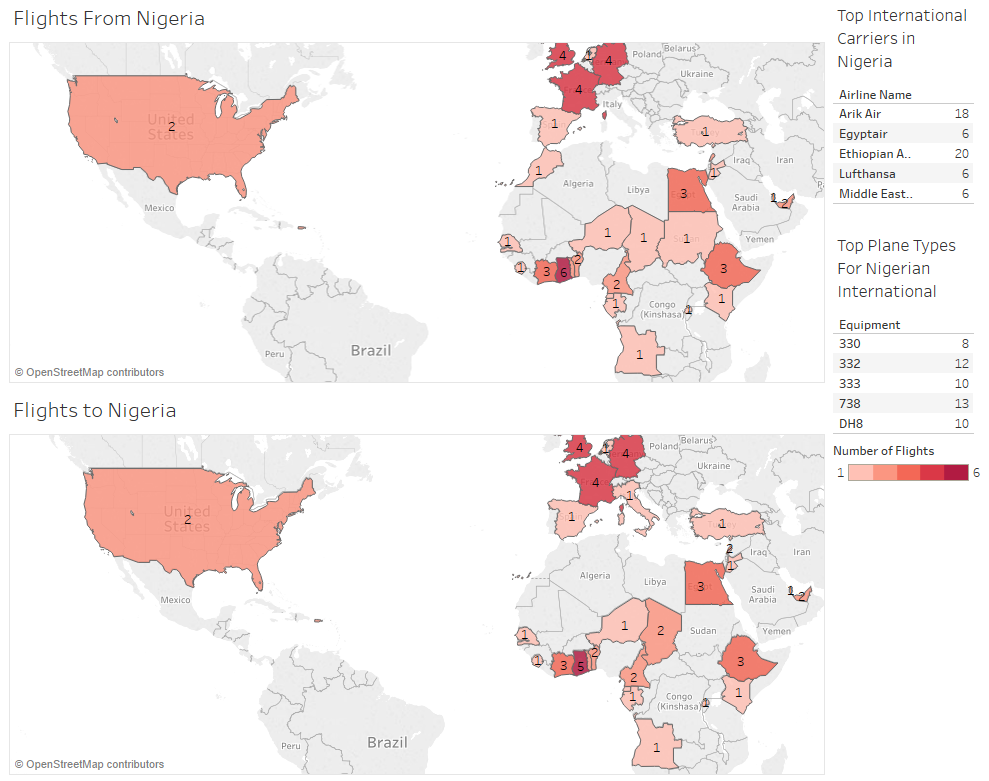

Ghana, Germany, France, and the United Kingdom top the charts in Nigerian international travel. These plus the next three top popular routes (Egypt, Cote D’Ivoire, and Ethiopia) account for 46% of all International air travel connected to Nigeria.

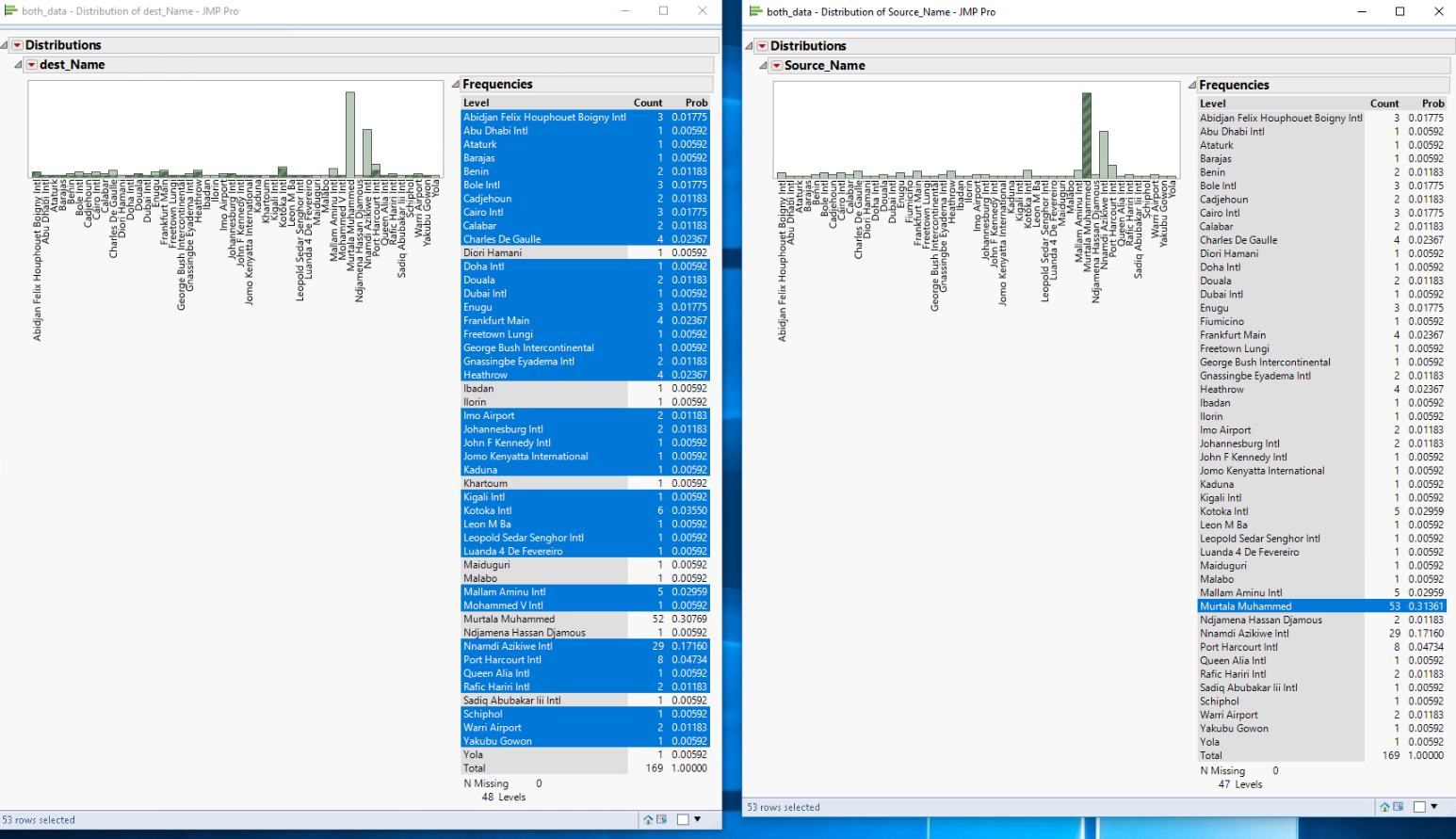

Lastly, JMP provides an interesting look of two connected histograms. The display below represents the connection between source and destination airports of Nigerian air travel. We can see that Mutala Muhammad International Airport sees the most flights, both incoming and outgoing, for the Nigerian air travel market. As such, this location should be the home base for Austin Air. This airport accounts for about 32% of all flights connected to Nigeria while also having a very wide spread of connecting airports (~80%)- seen by the highlighted airports on the left frequencies list.

Dashboard

Tableau dashboards have also been created for use by Austin Air stakeholders and management to explore at their own pace. Three dashboards split up information that is of interest to Austin Air. Although much of this data is another view at the findings represented in the presentation, this provides a second, segmented perspective for the audience to fully grasp the results of analysis. The first dashboard examines international data:

The dashboard includes hover tooltips to provide context and further information on the country, city, and airport names to and from Nigeria. Top airline competitors and plane types for these routes are also included on the right-hand side.

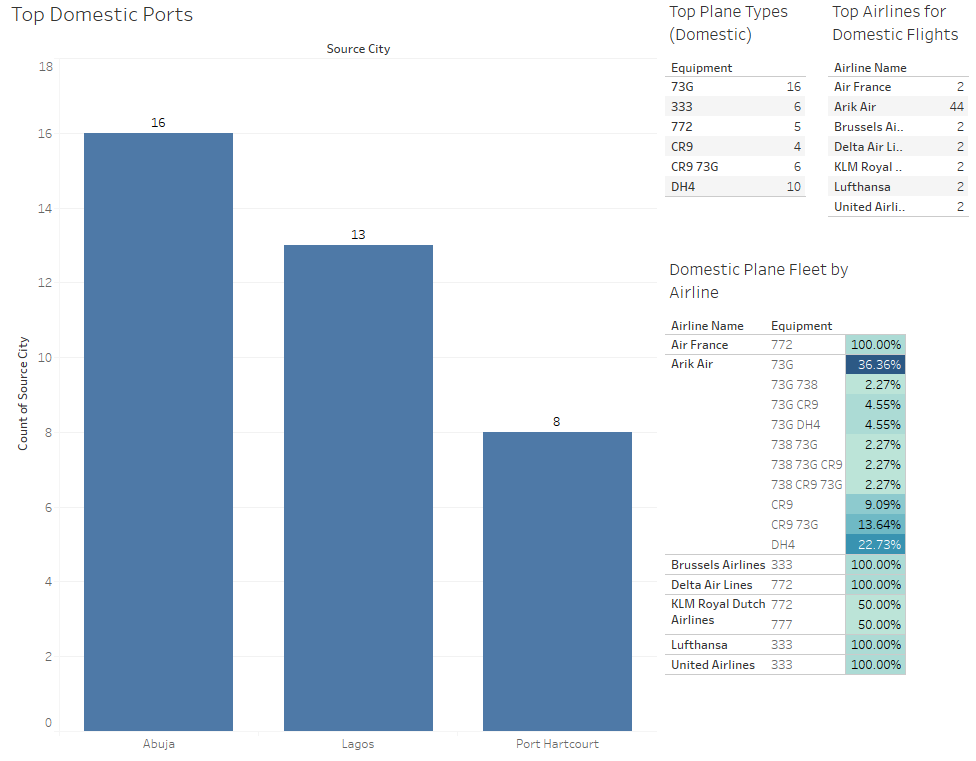

Similarly, domestic information is broken down and evaluated on the next dashboard:

Instead of a map, the primary image is a histogram of the top cities of popularity for domestic Nigerian flights. Domestic flights, as indicated above, represent 33% of all air travel in Nigeria, while these three cities account for 66% of that domestic travel. The lower costs of domestic flights can also help facilitate lower prices for international travelers as well. The bottom-right table displays the distribution of plane types for domestic flights, split by airline. Arik Air holds a dominate share of the market, and a similar fleet distribution for Austin Air’s domestic wing could be effective.

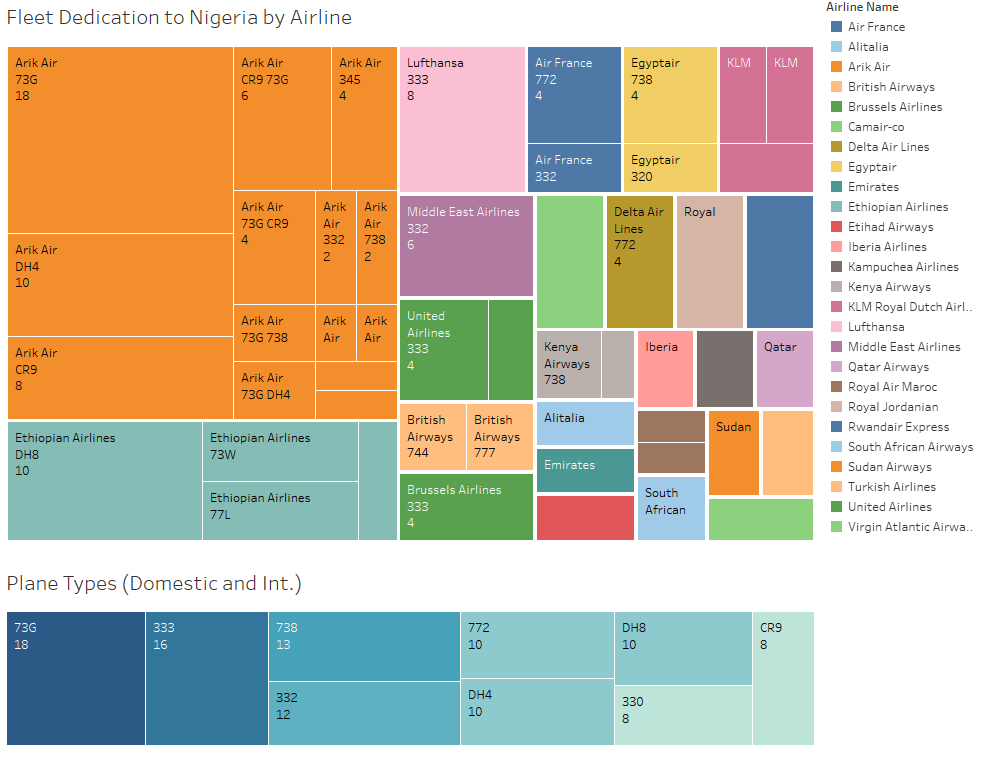

Lastly, a dashboard examining an aggregate of domestic and international data:

+

Although a bit more time consuming

to take in, the primary visual of this dashboard represents a look at plane

type distributions of each major airlines Nigerian flights (flights which

include Nigeria- both domestic and international). Again, it is seen that Arik

Air and Ethiopian Airlines currently control a large portion of the country’s air

traffic. Additionally included are the top 9 plane types (in aggregate) used

for Nigerian air routes.

Suggestions to Austin Air

With analysis complete, the value of the project can be examined with Austin Air’s overall goals in mind. The objectives of the project were to:

· Determine the busiest Airports typically linked to Nigerian airports.

· Decide how many of each plane type to initially invest into.

· Discover which routes should be direct, and which should be connections.

Although the latter objective was

impossible due to a lack of data, the two former goals can be directly answered

from the results of this analysis. Additionally, the team can also evaluate top

competition currently in the market. A three-pronged business strategy for

Austin Air follows which will help the company leverage these data-driven

insights towards achieving its overall goal of capturing a significant portion

of Nigerian air travel.

Suggested Distribution of Fleet

Although precise numbers cannot be determined due to lack of time reference of data collection, Austin Air should invest into a fleet with the following distribution of plane types:

-27% // 73G (Boeing 737-700)

-55% // A333 (Airbus 330-300)

-18% // DH8 (Bombardier Dash 8)

A distribution like this promotes a

focus of international travel without neglecting the revenue possible from

domestic flight service. The 73G’s should be prioritized towards domestic

flights, with one or two A333’s also devoted to domestic service as needed. The

majority of the A333 division should be the primary mode of international

travel. DH8’s- a smaller plane type- should be utilized towards the less busy

international routes. Contact with the original data collectors to obtain the

time-frame of the survey can provide a lead on the precise numbers these

distributions relate to.

Ports of Interest

Domestic service should primarily focus on Abuja, Lagos, and

Port Hartcourt as these account for about 21% of all Nigeria air traffic (66%

of the domestic). Countries which should be included in the beginning phase of Austin

Air’s international services are: Ghana, Germany, France, UK, Egypt, Ethiopia,

and Cote D’Ivoire (Ivory Coast). These seven countries account for 48% of

international traffic to and from Nigeria. Overall, the ten locations listed

above account for 52% of all flight to and from Nigeria. With a home-base of

Mutala Muhammad International Airport, Austin Air would also have direct, one-way

flight access to each of these locations.

Focus Marketing Against Direct Competitors

Lastly, Austin Air should conduct marketing competitor analysis to determine the strengths and weaknesses of its two top competitors: Arik Air and Ethiopian Airlines. Analysis results indicate that these two companies hold an extreme majority of the Nigerian air travel market share, both domestic and international. Successfully leveraging this knowledge can lead to finding strategies in which to outperform these two companies in price and customer expectations. Further, it could also hint at avenues to aggressively advertising against each company.

Each of these suggestions to Austin Air provide a strong launching point for the pilot program of the company. With further in-house data collection and analysis as the company grows, Austin Air will be able to follow the trends and insights found from big data analytics and utilize them towards making informed decisions while expanding the business. Following this route, Austin Air will not only start strong, but could quickly become the number one airline for Nigeria air travel and a large contender in the worldwide industry.